14++ Explain How Writing A Monthly Budget Helps You Manage Spending Download

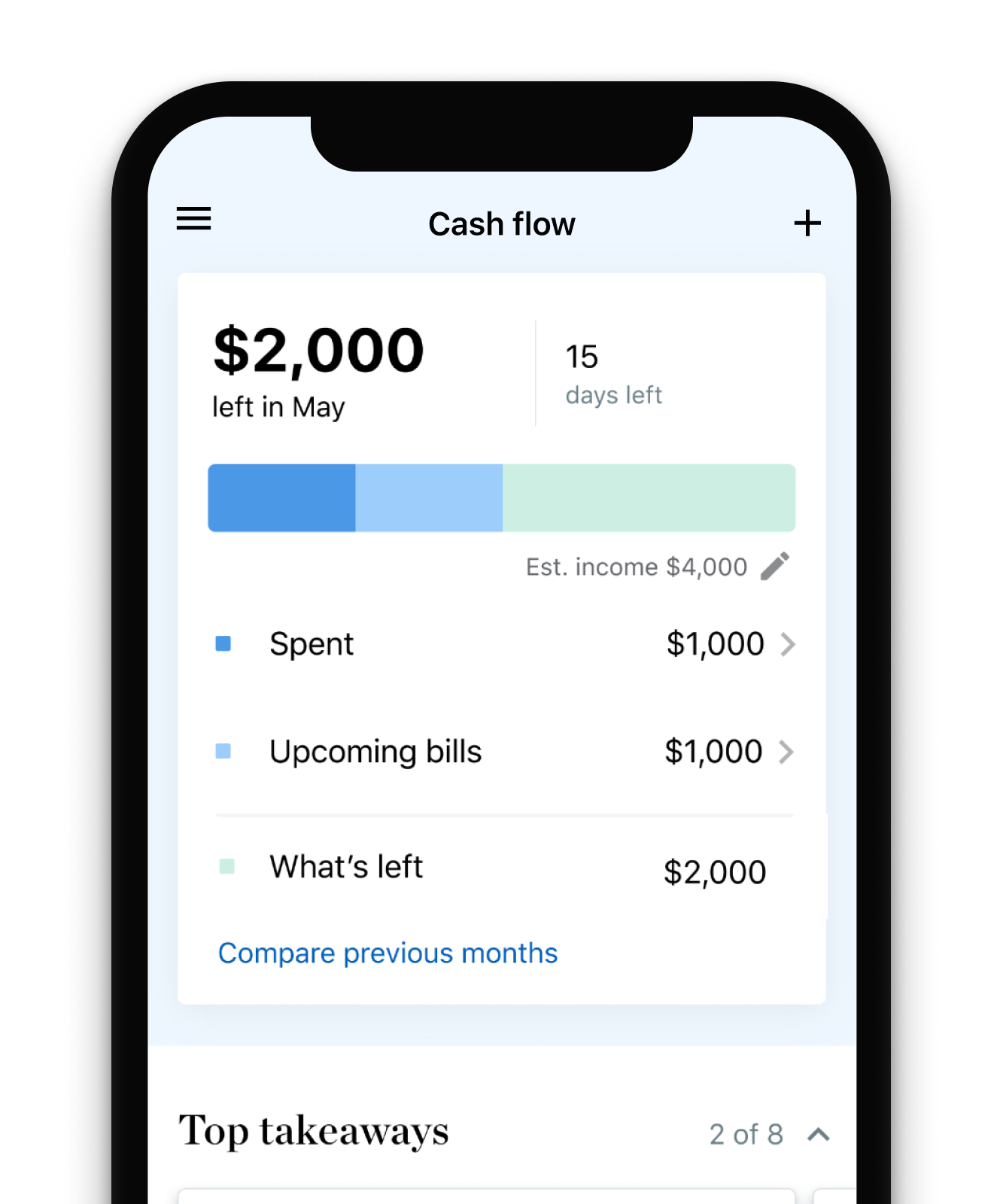

Explain how writing a monthly budget helps you manage spending. 39 Describe How and Why Managers Use Budgets. Compare your expenses to your income. Once you have your numbers add them up. Set aside money in your budget each month for. In other cases budgeting might reveal areas of wasteful spending that if cut out could help you move forward with longer-term projects. This spending plan is called a budget. Having a budget helps you to feel in control of your money. It may be getting out of debt saving up for a home or working on starting your own business. Another option for tracking your spending is syncing your checking account or credit cards to a budgeting app like Mint. It also helps you to be more intentional with your spending and saving. When you spend cash or write checks and enter them in a register youll more accurately see what your dong with your money. Implementation of a companys strategic plan often begins by determining managements basic expectations about future economic competitive and technological conditions and their effects.

The app automatically records your purchases for you and you can manually enter cash purchases or withdrawals from your bank account. The best way to give yourself flexibility is to make as many of your budgetary items operational or discretionary as you can. You cant effectively manage a project budget without establishing key performance indicators KPIs. If you are applying for funding you must say what you are planning to spend that funding on. Explain how writing a monthly budget helps you manage spending Use your budget to set limits on yourself and keep receipts to monitor your progress. Budgeting is valuable here because it gives you an idea of what is possible. Having every dollar spent on paper before the month begins ensures that your money doesnt just slip through your fingers. 2 Explain how writing a monthly budget helps you achieve financial goals. An operational budget item is one that you pay every month. The higher the variance the more help is needed in terms of management. Finally using cash isnt an excuse to visit an ATM when you get the urge to spend. Start by looking at where. You dont need an accountant or special software to set up your own budget.

How To Budget 4 Easy Steps To Get You Started

How To Budget 4 Easy Steps To Get You Started

Explain how writing a monthly budget helps you manage spending If they dont balance and you spend.

Explain how writing a monthly budget helps you manage spending. To make your monthly budget add up the total amount of money you spend every month from fixed and variable expenses. The budget is the primary tool financial analysts use to manage expenses and variances from the budget. Benefits of Budgeting Gives you control over your money A budget is a way of being intentional about the way you spend and save your money.

Develop relevant KPIs. Writing a monthly budget helps manage spending because if you do one then you can see how much you spend on certain things. Your budget creates a plan and lets you track it to make sure you are reaching your goals.

Then subtract that amount from your monthly income. Manage your own debt. Traditional personal finance software enables you to produce a monthly budget and create diagrams to illustrate your spending as well as track the status of.

More than that you need to show how spending that money will help you to answer your research question. Most people budget monthly because most bills follow a monthly schedule. Every research project needs a budget.

KPIs help you ascertain how much has been spent. A budget is a plan that helps you prioritize your spending. Budgeting is simply balancing your expenses with your income.

Budgeting helps you and your team see what kinds of expansion would be realistic. If you find out that you are spending too much on one certain thing then you should cut back on it. A monthly budget worksheet can help you with keeping track of expenses.

By comparing the budget to actual numbers analysts are able to identify any variances between budgeted and true costs. More than you make you will have a problem. You can put aside money for big bills when they arrive and plan savings to achieve your money goals.

With a budget you can move to focus your money on the things that are most important to you. It is said that with budgeting you control your money and not your money controls you. Budgeting saves you the stress of suddenly having to adjust to lack of funds because you did not initially plan how to spend them.

1 Explain how writing a monthly budget helps you manage spending. So developing the budget is the perfect time to plan your project. In previous years when you underspent your next years budget.

An example of a typical stupid budgeting game that managers play is use-it or lose-it spending It is when you are getting close to the end of the year and your budget is running under your forecast. If you dont know the exact amount you can use an estimate. Start by making a list of your monthly income sources including your salary after taxes any bonuses you incur on a regular basis and child support or alimony payments.

Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. That is why you should always do a.

Explain how writing a monthly budget helps you manage spending That is why you should always do a.

Explain how writing a monthly budget helps you manage spending. Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. Start by making a list of your monthly income sources including your salary after taxes any bonuses you incur on a regular basis and child support or alimony payments. If you dont know the exact amount you can use an estimate. An example of a typical stupid budgeting game that managers play is use-it or lose-it spending It is when you are getting close to the end of the year and your budget is running under your forecast. In previous years when you underspent your next years budget. So developing the budget is the perfect time to plan your project. 1 Explain how writing a monthly budget helps you manage spending. Budgeting saves you the stress of suddenly having to adjust to lack of funds because you did not initially plan how to spend them. It is said that with budgeting you control your money and not your money controls you. With a budget you can move to focus your money on the things that are most important to you. You can put aside money for big bills when they arrive and plan savings to achieve your money goals.

More than you make you will have a problem. By comparing the budget to actual numbers analysts are able to identify any variances between budgeted and true costs. Explain how writing a monthly budget helps you manage spending A monthly budget worksheet can help you with keeping track of expenses. If you find out that you are spending too much on one certain thing then you should cut back on it. Budgeting helps you and your team see what kinds of expansion would be realistic. Budgeting is simply balancing your expenses with your income. A budget is a plan that helps you prioritize your spending. KPIs help you ascertain how much has been spent. Every research project needs a budget. Most people budget monthly because most bills follow a monthly schedule. More than that you need to show how spending that money will help you to answer your research question.

Budgeting For College Students Where To Start Nerdwallet

Budgeting For College Students Where To Start Nerdwallet

Traditional personal finance software enables you to produce a monthly budget and create diagrams to illustrate your spending as well as track the status of. Manage your own debt. Then subtract that amount from your monthly income. Your budget creates a plan and lets you track it to make sure you are reaching your goals. Writing a monthly budget helps manage spending because if you do one then you can see how much you spend on certain things. Develop relevant KPIs. Benefits of Budgeting Gives you control over your money A budget is a way of being intentional about the way you spend and save your money. The budget is the primary tool financial analysts use to manage expenses and variances from the budget. To make your monthly budget add up the total amount of money you spend every month from fixed and variable expenses. Explain how writing a monthly budget helps you manage spending.

Explain how writing a monthly budget helps you manage spending