50++ Does Getting A New Credit Card Lower My Credit Score Info

Does getting a new credit card lower my credit score. Opening a credit card will only drop your credit score by a handful of points and it should recover after about a year of adding positive payment activity to your credit reports. Most credit applications result in a hard inquiry which means the lender pulls your credit report from one of the main three credit bureaus Experian Equifax or TransUnion. Its true that a new account on your credit profile can actually lower your scores a bit since a new account especially one with a balance is considered a risk factor. While new card accounts often lower your credit score about five points it. If youre thinking about opening a new credit card and are wondering whether it will help your credit score the answer is yesand no. An additional 5000 credit limit increases. What other experts said. Opening new credit accounts can also have a negative effect on your score. I wouldnt suggest you avoid using the card altogether. In addition a new credit card will lower the average age of your credit lines. This in effect lowers your length of credit history and subsequently your credit score. Therefore every new credit card you open decreases the average length of your credit history.

Should I get a new card to help boost my credit score. Add another new credit card to the mix and the effect multiplies. A new credit card or line of credit will also affect your length of credit history. If you dont make any new purchases on your credit cards including the new one your overall credit utilization will drop and your credit score could increase. Does getting a new credit card lower my credit score The credit scoring model looks at the new credit youve applied for recently to calculate 10 percent of your credit score. In some cases opening a new credit card can improve your credit score. If you apply for a lot of new credit in a short period of time your credit score can fall a bit because youre viewed as a riskier borrower. Applying for a new card can initially lower your score because the card issuer will do a hard credit pull when deciding whether to approve your application. Opening new credit lowers the average age of your total accounts. If you open a new credit card that comes with a credit limit of 5000 youd. To maintain a good credit score youll need to keep this number to 30 or less and ideally 10 or less if possible. You just dropped your utilization ratio from 40 to 33 just by opening a new card. Keeping trade lines open and active for many years helps your credit score while closing old accounts can lower it.

Why Did My Credit Score Drop Top 10 Causes

Why Did My Credit Score Drop Top 10 Causes

Does getting a new credit card lower my credit score The good news is that I regained 33 of those points a few weeks after that.

Does getting a new credit card lower my credit score. Opening a new credit card account could lower or hurt your credit score in the short term because it requires a hard inquiry on your credit. A new credit card might hurt your score if make a big purchase or you get a balance-transfer card and transfer your higher-interest debt to the card so that you have high credit utilization. The credit issuer will check your credit score and report when you apply for the account.

But any dip will be temporary and over time things should even out. But Im still surprised that my new credit card application if that was in fact the reason caused my score to drop 41 points in less than two months. Perhaps the biggest potential benefit to opening a new credit card at least from a credit scoring perspective is the fact that the new account might lower your overall credit utilization rate.

This part of your score is made up of your oldest account and the average of all your accounts. You may have heard that opening a new credit card will cause your credit score to automatically plunge. A new credit card can temporarily knock a few points off your score but it could help in the long run.

Over time though it can help build a better credit history if you pay it on time and carry minimal debt.

Does getting a new credit card lower my credit score Over time though it can help build a better credit history if you pay it on time and carry minimal debt.

Does getting a new credit card lower my credit score. A new credit card can temporarily knock a few points off your score but it could help in the long run. You may have heard that opening a new credit card will cause your credit score to automatically plunge. This part of your score is made up of your oldest account and the average of all your accounts. Perhaps the biggest potential benefit to opening a new credit card at least from a credit scoring perspective is the fact that the new account might lower your overall credit utilization rate. But Im still surprised that my new credit card application if that was in fact the reason caused my score to drop 41 points in less than two months. But any dip will be temporary and over time things should even out. The credit issuer will check your credit score and report when you apply for the account. A new credit card might hurt your score if make a big purchase or you get a balance-transfer card and transfer your higher-interest debt to the card so that you have high credit utilization. Opening a new credit card account could lower or hurt your credit score in the short term because it requires a hard inquiry on your credit.

Does getting a new credit card lower my credit score

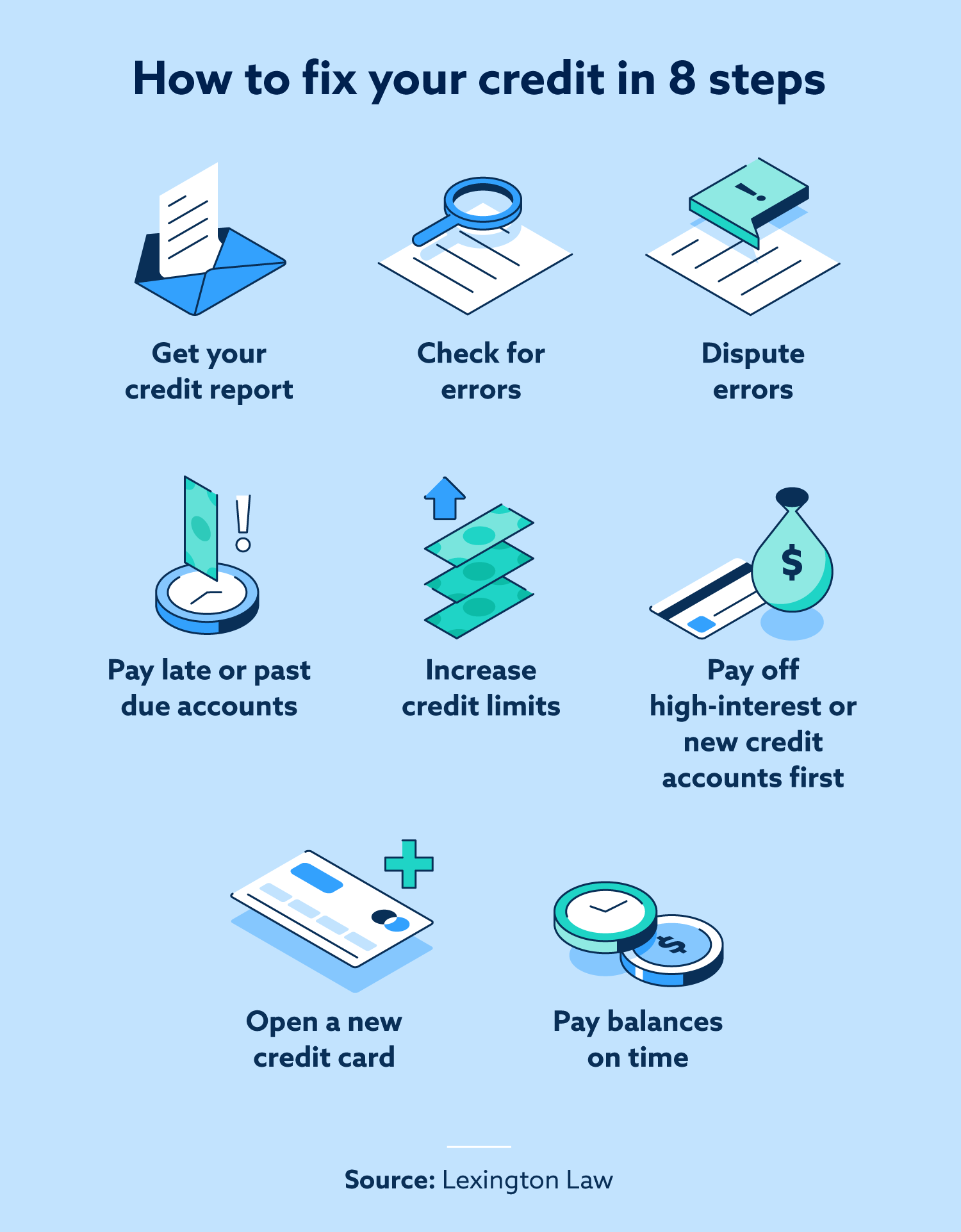

How To Fix Credit In 8 Easy Steps Lexington Law

How To Fix Credit In 8 Easy Steps Lexington Law