34+ Can I Get Title Insurance With A Quit Claim Deed Download

Can i get title insurance with a quit claim deed. Paired with title insurance your warranty deed guarantees that the grantor is the rightful owner and transfers these rights and title to you as the grantee or new owner of the property. Most investors have either heard of or use a Quit Claim Deed as a method of granting title to another person or entity ie. Can I Get Title Insurance with a Quit Claim Deed. Generally speaking most title companies wont work with a quit claim deed because it offers no guarantees on behalf of the seller and opens the title insurance company up to the highest level of risk in the event of a title dispute. Contact a real estate lawyer or a title company in your area about insuring your title. I believe you can only get title insurance for the purchase price so if you were purchasing for only a few hundred dollars. Martin general counsel of All New York Title Agency in. A real estate purchaser under a quitclaim deed is in many legal situations considered to. The next time you think about transferring title be certain how the type of conveyance will affect your title insurance policy. However the only way you can be sure is asking. Most property sales make use of a warranty deed. Do Quit-Claim Deeds Convey Marketable Titles.

Unless there is some problem with the quit claim deed you should be able to get title insurance. Because no warranty or guarantee is made regarding the actual state of the title when a quitclaim deed is used title insurance cannot be obtained. Theyre as effective as a warranty deed to transfer title but only if the title is good. As a practical matter while the law may allow the seller to buy new title insurance the title insurance company may not be in hurry to provide that insurance if the seller isnt willing to provide any warranties as to ownership and encumbrances. Can i get title insurance with a quit claim deed Generally new owners can purchase title insurance for property transferred through a quitclaim deed. These reports are used primarily when a property is being sold to ensure the title is free of liens and for title insurance purposes. Title insurance is favorable and often required by mortgage lenders. And generally the title company will assist you in this effort. To be legal this must be filed at a recorders office in the area in which the property is located. Perhaps the informality is due to estate planning or the relationship between the grantor and grantee nonetheless the conveyance is without warranties thus could discontinue title insurance coverage. LLC S-Corp Trust etc This method is of liability protection is popular. They were burned when some scammers down here were filing falsified quit claim deeds and transferring ownership when they didnt even own the property. Title insurance is available when a warranty.

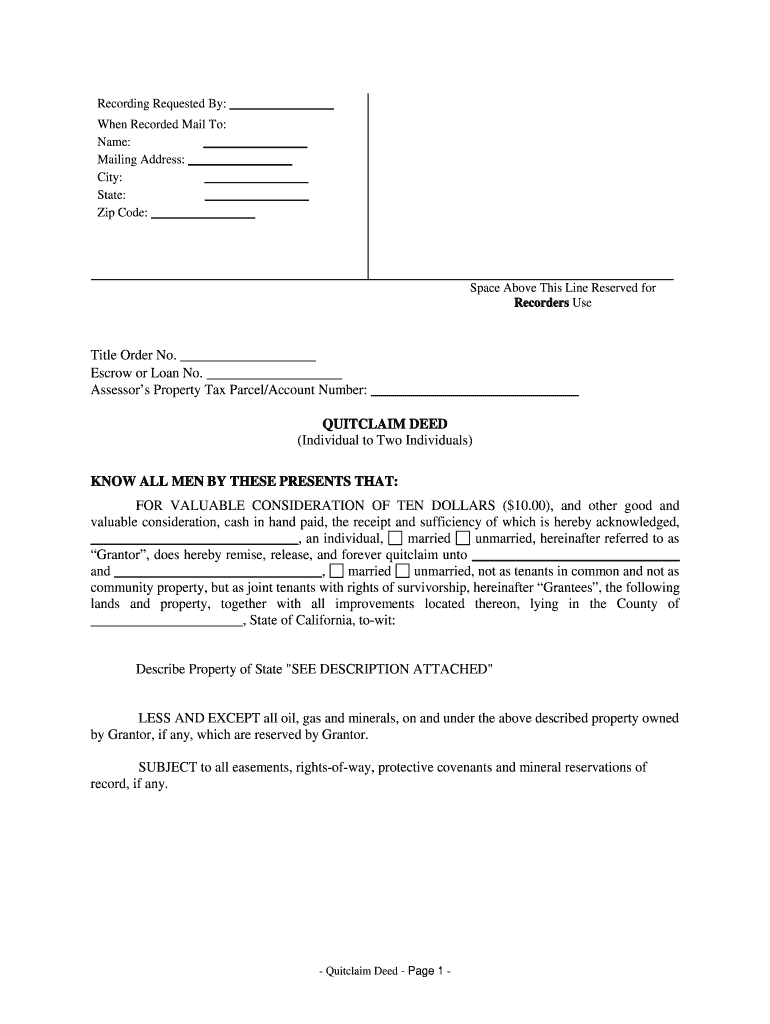

Joint Tenancy Quit Claim Deed Form Fill Online Printable Fillable Blank Pdffiller

Joint Tenancy Quit Claim Deed Form Fill Online Printable Fillable Blank Pdffiller

Can i get title insurance with a quit claim deed A -- It is a common misconception that a quit-claim deed is uninsurable by title companies said John M.

Can i get title insurance with a quit claim deed. Of all deed forms the quitclaim deed gives the buyer the least amount of protection. With a warranty deed your title is clear. This is largely at the discretion of the title insurance company underwriting insurance company.

It is common for real estate to be conveyed with quit claim deeds andor no title insurance. A quitclaim deed can convey title as effectively as a warranty deed if the grantor has a good title when. A quit claim deed transfers title as well as a warranty deed.

When attempting to purchase a real property from a seller who has a quit claim deed there are ways to get around this problem. Deeds come in different types with some providing more protection to the buyer than others. When purchasing a home the buyer should receive a general warranty deed not a quitclaim deed.

Selling a home with a quitclaim deed. You can then buy title insurance and with legal title transfer the property through a warranty deed. A seller of real estate uses a deed to convey title or interest in the property to the buyer.

Can i get title insurance with a quit claim deed A seller of real estate uses a deed to convey title or interest in the property to the buyer.

Can i get title insurance with a quit claim deed. You can then buy title insurance and with legal title transfer the property through a warranty deed. Selling a home with a quitclaim deed. When purchasing a home the buyer should receive a general warranty deed not a quitclaim deed. Deeds come in different types with some providing more protection to the buyer than others. When attempting to purchase a real property from a seller who has a quit claim deed there are ways to get around this problem. A quit claim deed transfers title as well as a warranty deed. A quitclaim deed can convey title as effectively as a warranty deed if the grantor has a good title when. It is common for real estate to be conveyed with quit claim deeds andor no title insurance. This is largely at the discretion of the title insurance company underwriting insurance company. With a warranty deed your title is clear. Of all deed forms the quitclaim deed gives the buyer the least amount of protection.

Can i get title insurance with a quit claim deed

Guide To Quitclaim Deeds Bay National Title Company

Guide To Quitclaim Deeds Bay National Title Company