37++ Do We Have To Sign The Back Of A Check Info

Do we have to sign the back of a check. Along with your signature you can include directions such as For deposit in account 1234567 This way if your check is ever stolen or lost in the mail it cannot be used by anyone else. Today a cheque is just note of the account information and they are so rarely endorsed that signing the back isnt needed in most places. Strictly speaking once the front of a cheque is signed there is nothing you can write on it to make it not valid. If you receive a check youll need to sign the back to deposit or cash it. No interest paid and I get to stay more liquid. In these situations we often recommend that an owner or CEO be granted check signing authority. Void or sample or non negotiable have no legal effect on the validity of a cheque. If any of the above situations pertain to you you may need to send your stimulus check back. When you sign the back of the check youre basically assuming responsibility for the transaction and giving the bank permission to recoup the funds from you if the transaction does not process correctly. Heres how to do it for each scenario per the IRS. She presents this document to financial institutions to establish her authority to sign checks in the name of the deceased. If you are the maker of the check - that is the person who is writing the check to pay someone else - you should sign on the front of the check and NOT on the back.

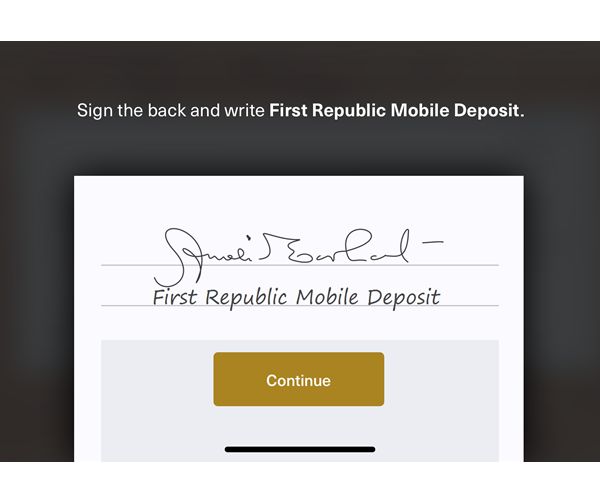

Ohh and rewards points. Do both of us have to sign the back of the check. This section known as the endorsement area is marked with lines and instructions saying Do not write stamp or sign below this line See Back of the check in the example image above Try to keep your entire signature and any other instructions for the bank in that area. Sign the back of the check as usual except keep your signature in the top section of the endorsement area. Do we have to sign the back of a check For example if youre mailing the check because you want to deposit it to another account you might write For deposit only and then write your account number. Letters Testamentary Without a Will. If the check is issued to John or Jane Doe generally either person can cash or deposit the check. Signing a check or endorsing the back of a check in red ink could trigger trouble by delaying payment of the check. When an executor or administrator is chosen the court issues documents -- termed letters testamentary -- that give the person the legal right to handle estate matters. If youre receiving a check youll need to sign the back of the check known as endorsing the check when you deposit or cash in the check. We do have the cash in the bank to do it but we always call up one of our credit cards ask for a 0 percent promo and use the 12 month term usually its that length to pay it off throughout the year. Sign the Back of the Check in the Top Section of the Endorsement Area Every check has an area on the back that reads Endorse Check Here This is where you will sign your name as it appears on the front of the check. Answered 1 year ago.

.jpg) Mobile Deposit Instructions Farmers State Bank

Mobile Deposit Instructions Farmers State Bank

Do we have to sign the back of a check Learn more from the Payments ProfessorWho has to sign a checkWhat if my check says and or.

Do we have to sign the back of a check. In extreme instances of fraud prevention it could even void the checks. Yes simply sign on the backside of the check As you normally would on a check that contains an X in the top left corner with the words Endorse Here. When someone pays you with a check youll usually have to sign the back of it before you can deposit it in your account.

Write VOID in the endorsement section on the. If the check is issued to two people such as John and Jane Doe the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. Along with your signature you might include instructions that limit how the check can be used.

Signing the back of it is called endorsing the check. If there are three lines sign the top line. Most checks have a 15-inch section on the back for you to write in.

This is not the time for a flamboyant John Hancock signature because you will need. Every now and then my wife and I have a big purchase to make. What you write when you sign ithow you endorse the checkdepends upon what you want to do with the check and how the check.

This is a practical solution for many privately-owned companies as owners should have ultimate disbursement authority within their organizations. The back of the check. Not signing checks is a bigger problem for the bank than it is for you.

Do we have to sign the back of a check Not signing checks is a bigger problem for the bank than it is for you.

Do we have to sign the back of a check. The back of the check. This is a practical solution for many privately-owned companies as owners should have ultimate disbursement authority within their organizations. What you write when you sign ithow you endorse the checkdepends upon what you want to do with the check and how the check. Every now and then my wife and I have a big purchase to make. This is not the time for a flamboyant John Hancock signature because you will need. Most checks have a 15-inch section on the back for you to write in. If there are three lines sign the top line. Signing the back of it is called endorsing the check. Along with your signature you might include instructions that limit how the check can be used. If the check is issued to two people such as John and Jane Doe the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. Write VOID in the endorsement section on the.

When someone pays you with a check youll usually have to sign the back of it before you can deposit it in your account. Yes simply sign on the backside of the check As you normally would on a check that contains an X in the top left corner with the words Endorse Here. Do we have to sign the back of a check In extreme instances of fraud prevention it could even void the checks.

Mobile Banking Security First Republic Bank

Mobile Banking Security First Republic Bank